Highlights:

- MCF Energy acquires European energy interests, including giant Welchau prospect in Austria to be spudded before Sept 2023; German prospect within a proven gas field

- Incoming MCF Energy leadership co-founded Europe focused Bankers Petroleum, which grew oil production by 2000% and achieved a peak market capitalization over $2.25 billion, as well as BNK Petroleum, formerly Europe's largest subsurface landholder of oil and gas leases

- $8.5 million private placement proposed fully subscribed with commitments from incoming management, insiders and institutions

VANCOUVER, BC, Nov. 29, 2022 /CNW/ - Pinedale Energy Limited (TSXV: MCF.H) ("MCF" or the "Company") (being renamed MCF Energy Ltd.) is pleased to announce that on November 29, 2022, it has entered into an assignment agreement and exclusive partnership with Kepis & Pobe Financial Group Inc. ("KPFG"), a leader in energy finance and development, to establish MCF as an active explorer and developer of new natural gas discoveries in Western Europe. Today's announcement provides MCF with significant hydrocarbon exploration assets in constrained markets, an accomplished leadership team with deep expertise in Europe, and initial capital to fund its commitments.

"MCF Energy was founded to strengthen Europe's energy security and provide critical resources for the energy transition," commented James Hill, incoming CEO. "Our vision is to leverage our expertise and capital to build the dominant new clean oil and gas company in Europe and deliver value for all stakeholders."

"Our group began seriously evaluating opportunities early this year," commented Jay Park KC, incoming Executive Chairman. "We found the landscape starved for capital and in need of fresh ideas. A comprehensive due diligence was conducted on more than 20 assets. Farm-in agreements were negotiated on the two highest priority projects."

"Never before has Europe so badly needed domestic energy," commented Ford Nicholson, incoming advisor to MCF Energy. "The race for high-quality energy assets in Europe is on, and MCF has secured significant gas potential in some of Europe's safest jurisdictions."

Assets:

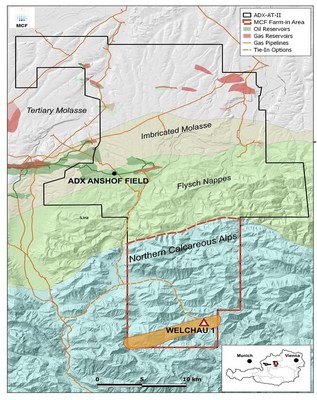

KPFG has agreed to assign to the Company (the "Assignment") its rights under two Joint Development Agreements covering projects in Germany and Austria. The first of these Joint Development Agreements (the "ADX Agreement") is with ADX VIE GmbH ("ADX") in respect of ADX's Welchau Well and the Welchau Area in Austria where MCF Energy can earn up to a 40% interest.

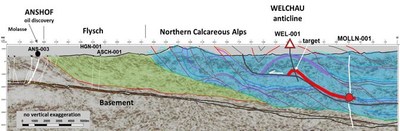

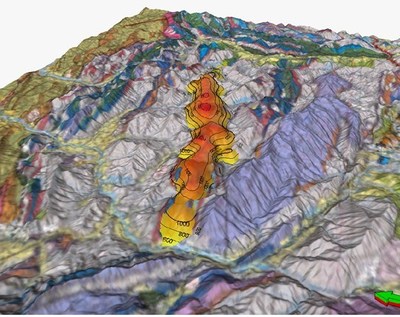

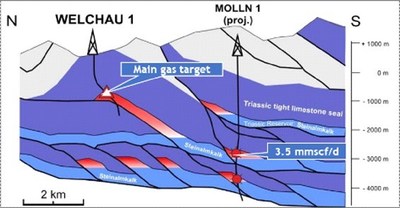

The Welchau gas prospect is located in the foothills of the Austrian Alps and is analogous to the large anticline structures discovered in Kurdistan and the Italian Apennines. Welchau has a relatively shallow target of approximately 1220 m True Vertical Depth, with a projected Total Depth of 1700 meters to evaluate all the potentially productive zones. The well is located with road access to the planned drilling location and a short tie-in distance to the national gas pipeline network of approximately 18 km.

Welchau is located up-dip from a gas discovery (Molln-1 well) drilled in 1989 which intersected a greater than 400 m gas column, with 900 meters interpreted from pressure data. The well tested condensate rich, pipeline quality gas (maximum flowrate of 3.5 mmcfpd with 40 barrels of condensate per mmcf) (refer to Figure 2).

The main target at Welchau, as well as the productive Molln 1 well, is the Triassic Steinalm Formation, a fractured carbonate reservoir trapped in a trending ramp anticline with more than 20 km lateral extent and 100 km2 maximum closure area. The structure is defined by extensive outcrop mapping and balanced 2D cross sections along a profile parallel to the North-South shortening direction.

Pursuant to the ADX Agreement, KPFG will fund up to 50% of the exploration drilling costs for the Welchau Well to a vertical depth needed to test the target Triassic limestone. The estimated exploration drill costs of the Welchau Well are EUR 3.81 million. Upon paying a 50% share of the costs KPFG will earn a 50% share of cost hydrocarbons and a 20% share of profit hydrocarbons, as defined in the ADX Agreement. Following payment of its initial 50% share, KPFG will thereafter be required to fund its profit hydrocarbon interest of the Welchau Well costs until the well is evaluated, cased and suspended, or completed, tested and tied in to production facilities. In addition, ADX has agreed to provide KPFG with an option, exercisable until January 21, 2023, whereby KPFG may elect to increase its participation interest in the Welchau Well and the Welchau Area to 100% of the cost hydrocarbons and a 40% share of the profit hydrocarbons by funding 100% of the exploration drill costs. In consideration for the grant of the Option, KPFG has agreed to pay a fee of EUR 100,000 to ADX within 10 days of entering into the Joint Development Agreement, which fee will be offset against its obligation to fund the Welchau Well long lead items if the Option is exercised. It is anticipated that the Welchau Well will be spudded on or before September 30, 2023.

The second of these Joint Development Agreements (the "Genexco Agreement") is with Genexco GmbH in respect of Genexco's exploration rights in the Reudnitz prospect and other opportunities in Germany. The Reudnitz prospect is a confirmed gas accumulation established by three previously drilled and abandoned wells, and a production licence application has been commenced. Pursuant to the Genexco Agreement, several additional 3D seismic controlled prospects in Germany are in the application stage, as directed by KPFG, and assignable to MCF, as well.

In consideration for the Assignment, the Company will issue an aggregate of 25 million MCF common shares at an effective share price of $0.20 per common share to certain current KPFG stakeholders, including Jay Park KC, James Hill and Ford Nicholson.

Leadership:

James Hill is expected to be appointed CEO and a Director of MCF. Mr. Hill is a professional geologist with over 40 years of technical and executive level experience in petroleum and natural gas exploration and development. Mr. Hill is the former Vice President of Exploration for BNK Petroleum and Bankers Petroleum.

Jay Park KC is expected to be appointed Executive Chairman of MCF. He is a renowned energy lawyer and entrepreneur based in London, UK. Mr. Park has provided legal advice to energy projects globally for over 40 years. He is the founder of Park Energy Law and former Chairman and CEO of Reconnaissance Energy Africa.

General Wesley Clark, a former director of Bankers Petroleum and BNK Petroleum, has agreed to join MCF Energy's Board of Directors. General Clark served 38 years in the United States Army. His last military position was NATO's Supreme Allied Commander and the Commander-in-Chief of the U.S. European Command. He now heads his own strategic advisory and consulting firm, Wesley K. Clark & Associates. General Clark graduated first in his class from West Point. He has received numerous honorary degrees and awards including the Presidential Medal of Freedom, the Silver Star, Purple Heart and honorary knighthoods from the United Kingdom and the Netherlands.

Accomplished energy executive Ford Nicholson has agreed to join MCF as a strategic advisor to help steer its growth. Mr. Nicholson was a co-founder of Nations Energy, acquired by CITIC for US $1.91 billion in 2006. He was Deputy Chairman of InterOil, acquired by ExxonMobil for US $2.5 billion in 2016. Mr. Nicholson was a co-founder and director of Bankers Petroleum, an oil producer in Europe acquired by Geo Jade for $575 million in 2016. He co-founded BNK Exploration which conducted explorations in six European countries. Mr. Nicholson also serves as Managing Director of KPFG.

Gordon Keep, who was an early partner of Nicholson in establishing Bankers Petroleum, will also join MCF as a strategic advisor. Mr. Keep is an experienced investment banking executive who has helped found several significant natural resources ventures including Endeavour Mining, Lithium X Energy and Wheaton Precious Metals.

MCF Energy will appoint two additional experienced directors to its board on closing.

Financing:

In connection with the Assignment, the Company is undertaking a non-brokered financing (the "Financing") of up to 42,500,000 subscription receipts at a price of $0.20 per subscription receipt for gross proceeds of $8,500,000. Each subscription receipt will convert into one common share of the Company concurrently with closing of the Assignment. The Financing is fully subscribed with commitments from incoming management, existing shareholders and institutions. The proceeds from the Financing will be held in escrow pending closing of the Assignment and will be used to fund the Company's initial obligations under the ADX and Genexco Agreements and for general working capital. New securities issued under the Financing will have a four month hold period from the closing of the transaction.

The Company anticipates that the Assignment and the Financing will constitute the reactivation of the Company from the NEX Board under Exchange policies, and that upon closing, the Company will be listed on Tier 2 of the Exchange as an Oil & Gas Issuer. Trading in the shares of the Company will remain halted until closing of the transaction. Both the Financing and the acquisition of the Assignment are subject to a potential finders fee, not to exceed the 5% of the gross proceeds raised from subscriptions in the Financing, and the gross value of the Assignment, introduced by certain arm's length finders (the 'Finders Fee'). Final approval of the Assignment, the Financing, payment of any Finders Fees and the reactivation are subject to TSXV approval. The Assignment is an arm's length transaction.

Completion of the private placement is subject to the acceptance for filing of the TSX Venture Exchange. The securities issued by the Company in connection with this offering are subject to a four-month "hold period" as prescribed by the TSX Venture Exchange and applicable securities laws.

For corporate updates, please register to our mailing list at www.MCFEnergy.com and follow us on twitter @MCFEnergy.

Cautionary Statements:

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Forward-Looking Information

Except for the statements of historical fact, this news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates and projections as at the date of this news release. The information in this news release about the completion of the proposed transaction and financing described herein, and other forward-looking information includes but is not limited to information concerning the intentions, plans and future actions of the parties to the transactions described herein and the terms of such transaction. Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, risks related to the Company's inability to perform the proposed transactions.

The forward-looking information in this news release reflects the current expectations, assumptions and/or beliefs of the Company based on information currently available to the Company. In connection with the forward-looking information contained in this news release, the Company has made assumptions about the Company's ability to complete the planned transaction and activities. The Company has also assumed that no significant events will occur outside of the Company's normal course of business. Although the Company believes that the assumptions inherent in the forward-looking information are reasonable, forward-looking information is not a guarantee of future performance and accordingly undue reliance should not be put on such information due to the inherent uncertainty therein.

Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or otherwise.

THIS PRESS RELEASE, REQUIRED BY APPLICABLE CANADIAN LAWS, IS NOT FOR DISTRIBUTION TO U.S. NEWS SERVICES OR FOR DISSEMINATION IN THE UNITED STATES, AND DOES NOT CONSTITUTE AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO SELL ANY OF THE SECURITIES DESCRIBED HEREIN IN THE UNITED STATES. THESE SECURITIES HAVE NOT BEEN, AND WILL NOT BE, REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED, OR ANY STATE SECURITIES LAWS, AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES OR TO U.S. PERSONS UNLESS REGISTERED OR EXEMPT THEREFROM.

This news release shall not constitute an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction.

SOURCE Pinedale Energy Limited Profile

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2022/29/c6294.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2022/29/c6294.html